Young Households Experienced Largest Gains for Homeownership in 2019

Young households (those under the age of 35) experienced the largest gains for homeownership in 2019, according to data from the Federal Reserve Board’s 2019 Survey of Consumer Finances (SCF). Shares of auto loans also increased, while the share with education loans declined.

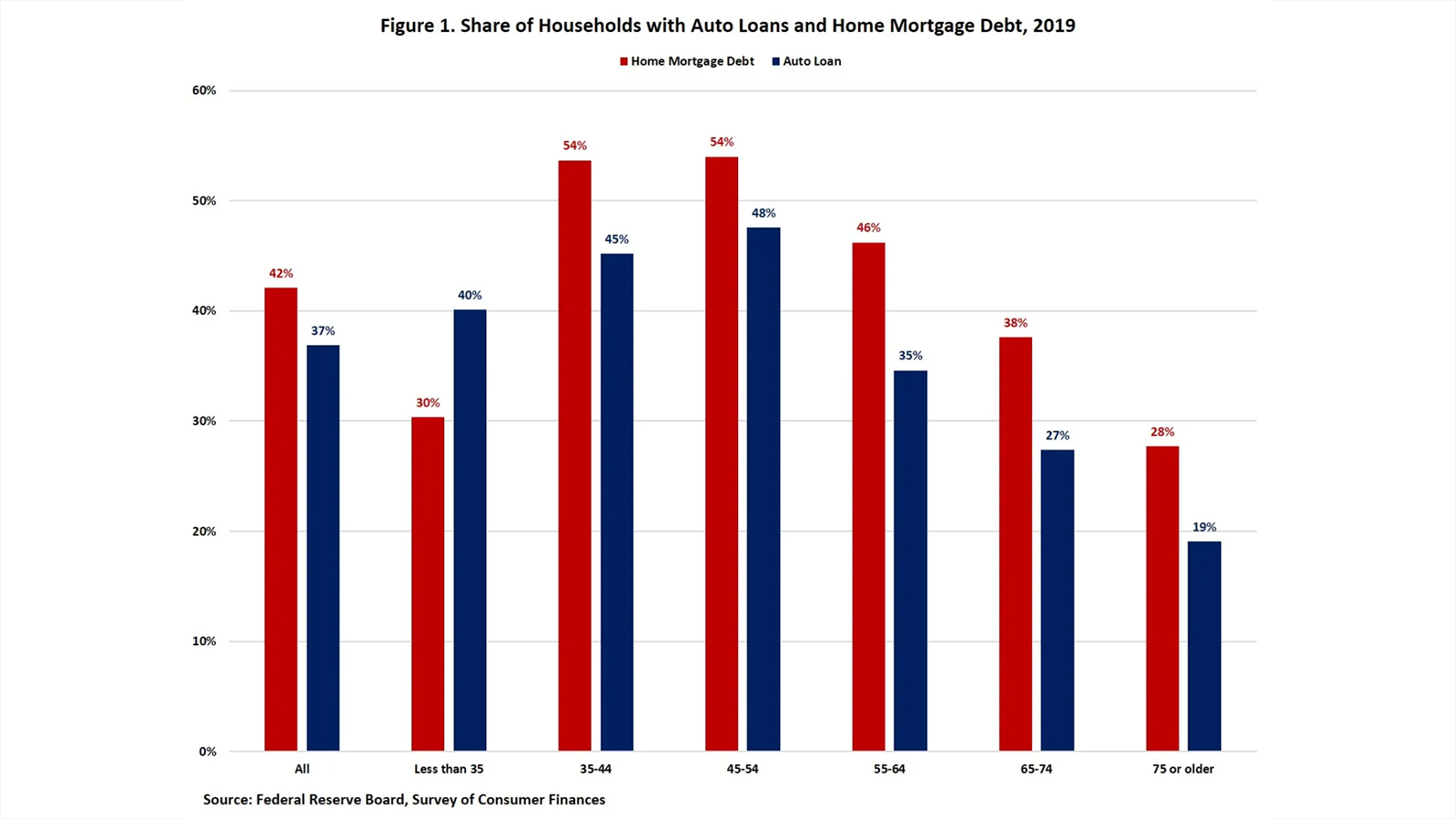

Overall, the share of households with home mortgage debt (42%) was greater than the percentage of households with auto loan debt (37%), a difference that held true for all age groups 35 and above. The overall share with home mortgage debt remained virtually unchanged from 2016 to 2019 at 42%, while the share of all households with auto loans increased from 34% to 37%.

In 2019, the share of young households with auto loans rose to the highest level since 2010, when the percentage of young households with auto loans (32%) dipped below the percentage with home mortgage debt (34%). The share of households under the age of 35 with auto loan debt has steadily increased in the years following.

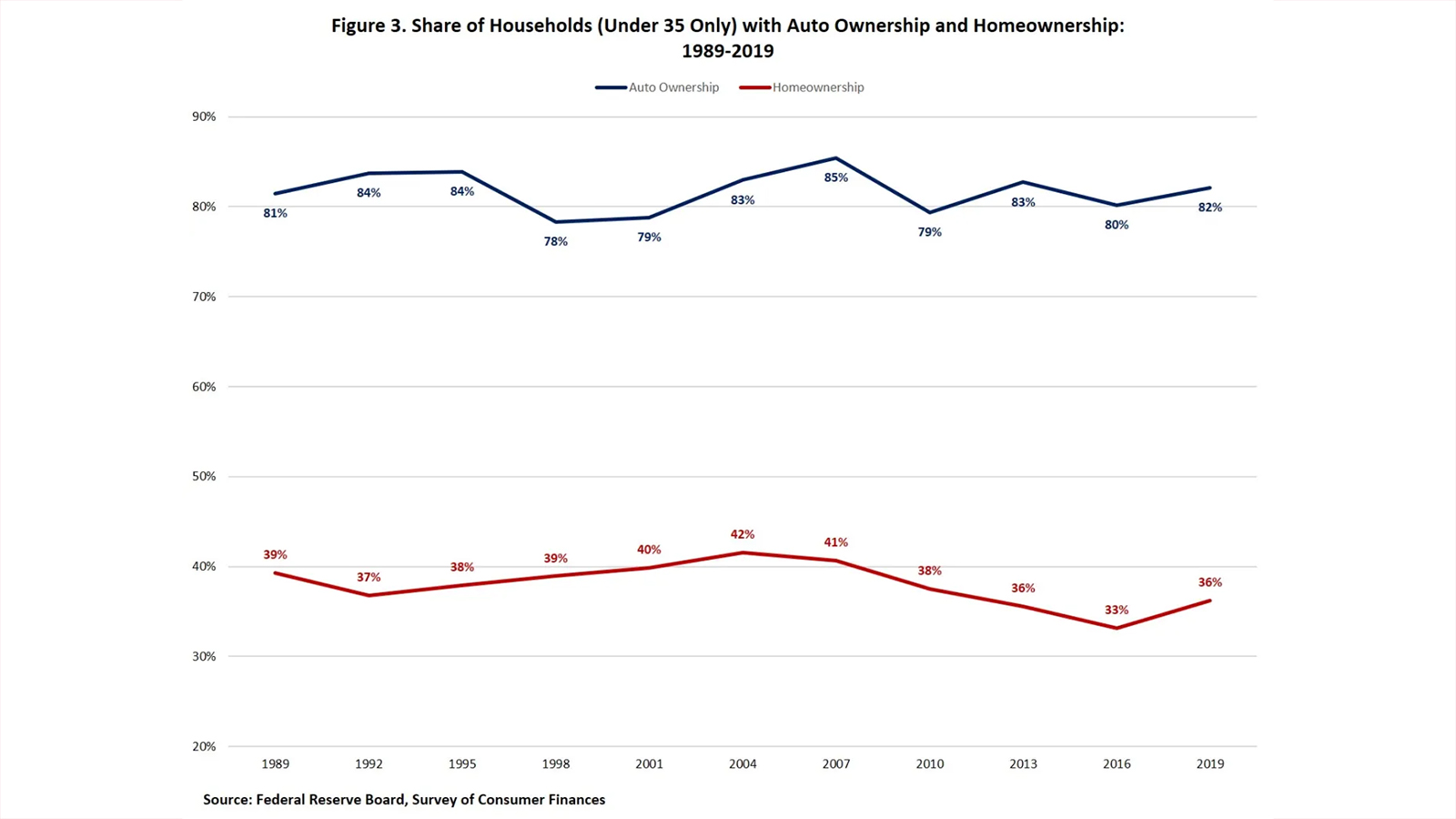

Overall auto ownership for young households has remained at a normalized level (82%) over the years, while the homeownership rate — although low (36%) — saw an increase after years of declines.

NAHB Economist Fan-Yu Kuo provides more analysis in this Eye on Housing post.