How Builders Are Dealing with Rising Lumber Prices

As NAHB continues to work tirelessly to combat rising lumber prices and supply shortages by aggressively engaging with the Biden administration and members of Congress, builders who are on the frontlines are engaging in several strategies to mitigate this unprecedented price surge that is raising housing costs and impacting their bottom lines.

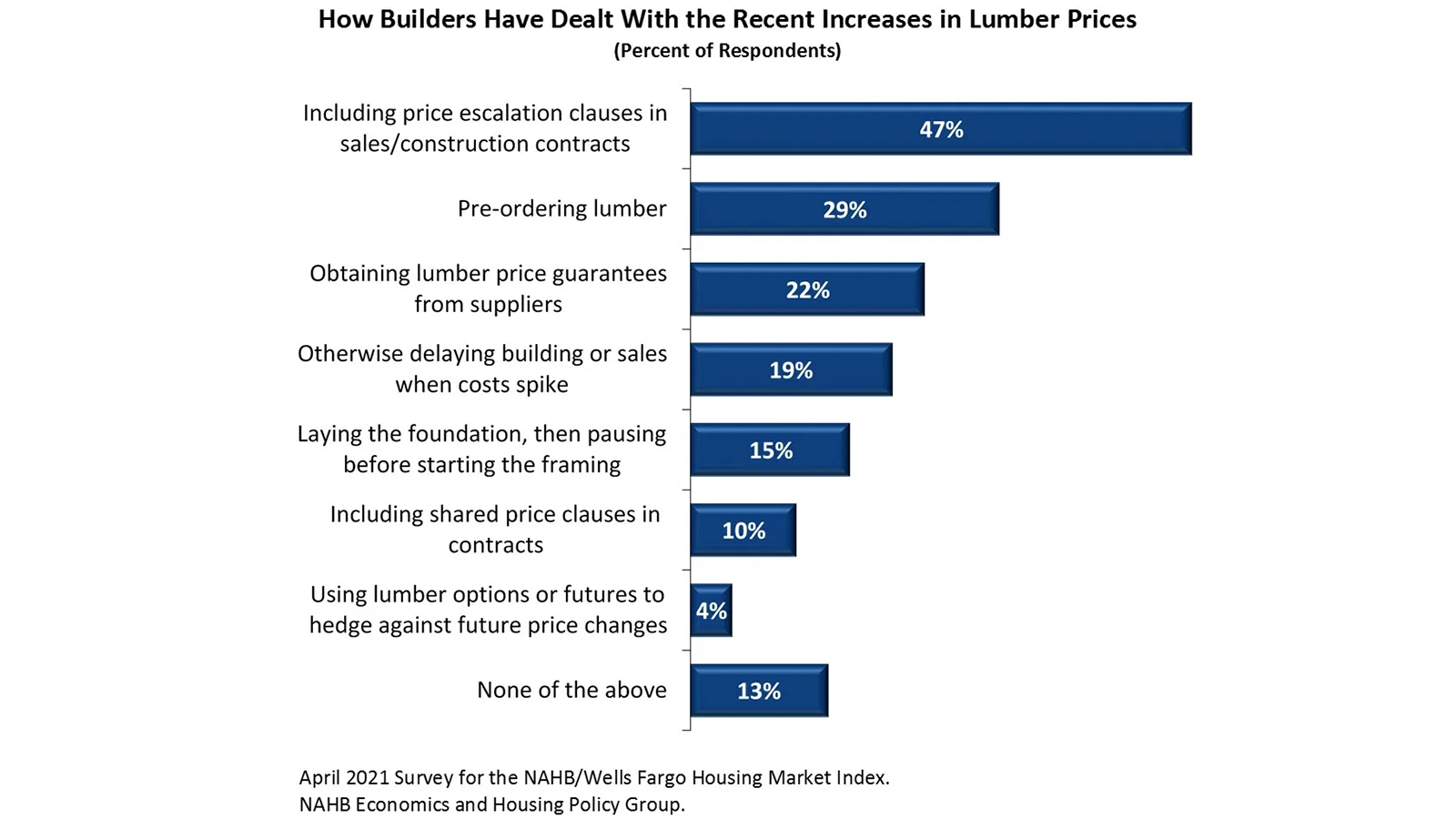

NAHB recently asked builders about their reactions to the rising and volatile lumber prices in its April 2021 survey for the NAHB/Wells Fargo Housing Market Index (HMI). Nearly half (47%) of single-family builders in the HMI panel indicated that they were including price escalation clauses in their sales contracts as their primary mitigation effort.

“It’s been a difficult time for us and home owners,” Jeremy Burke, a remodeler in Pennsylvania, shared through NAHB’s online lumber testimonial form. “We have had to prepare contracts with clauses for material change orders when materials cost rise — which I fear means we will lose contacts and/or projects for those who can’t afford the extra costs.”

Other efforts include pre-ordering lumber (29%) and obtaining lumber price guarantees from suppliers (22%). According to responses, prices were typically guaranteed for 15-29 days (42% of respondents reported) or 30-59 days (33% of respondents reported), for a median length of 28 days.

“We are pricing each unit on a case-by-case basis, and only after we have a commitment on actual lumber costs for that unit,” noted Thomas Troy, a builder in New Jersey, in a testimonial. “We are at the point where we are withholding new sections in some projects.”

Nearly one in five builders (19%) have also, unfortunately, had to delay building or sales when costs spike, and 15% indicated they are laying the foundation but pausing before framing. This puts further strain on the much-needed housing supply necessary to help make housing affordable.

“We have always prided ourselves on being able to provide affordable housing to our local market, while also being financially prudent to the best practices in the building industry,” stated Michael Welty, a builder in Colorado, in a testimonial. “When you couple these price increases with the limited amount of supply that currently resides in our housing market, the current conditions are creating an escalating market that in our opinion will eventually be unsustainable.”

Paul Emrath, vice president of surveys and housing policy research, provides more analysis and details in this Eye on Housing post.