Housing Affordability Explained in One Pyramid

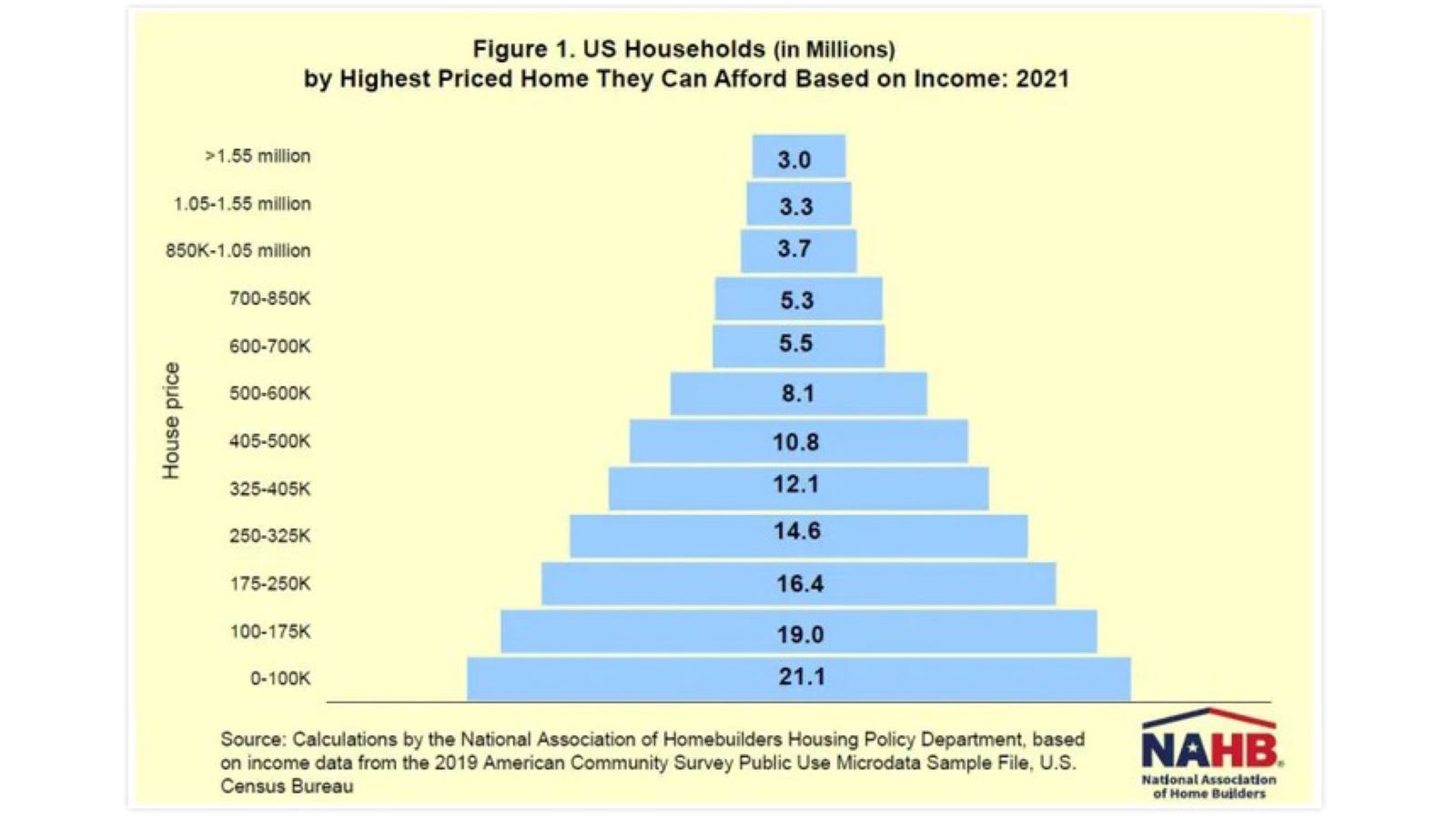

Applying conventional underwriting standards that the cost of a mortgage, property taxes and property insurance should not exceed 28% of household income, NAHB economists have calculated how many households have enough income to afford a home at various price thresholds.

The housing affordability pyramid shown below reveals that 56.5 million households out of a total of 122.9 million are unable to afford a $250,000 home. At the base of the pyramid are 21.1 million U.S. households with insufficient incomes to be able to afford a $100,000 home.

The pyramid’s second step consists of 19 million with enough income to afford $100,000 but not $175,000, and so on up the pyramid. Adding up the bottom three steps shows that there are 56.5 million households who cannot afford a $250,000 home.

This helps put affordability concerns into perspective and goes a long way toward explaining the result published in a September 2019 Eye on Housing post that 49% of home buyers are looking to buy homes priced under $250,000.

The top of the pyramid shows that 10 million households have enough income to buy a $850,000 home, and 3 million even have enough for a home priced at $1,550,000. But market analysts should never focus on this to the exclusion of the wider steps that support the pyramid’s base.

On March 1, NAHB released its new Priced-Out Estimates for 2021, which shows that a $1,000 increase in the price of a median-priced new home will price 153,967 U.S. households out of the market for the home.

Prospective home buyers also are adversely affected when interest rates rise. NAHB’s priced-out estimates show that, depending on the starting rate, a quarter-point increase in the rate of 2.8% with zero points on a 30-year fixed-rate mortgage can price over 1.3 million U.S. households out of the market for the median-priced new home.

NAHB economist Na Zhao provides more analysis in this Eye on Housing blog post.